Arden Believe’s knowledgeable trust professionals performs directly with folks and you can family so you can permit the seamless delivery of a trustor’s attention, if you are taking a continuously exceptional quantity of services. Arden Faith Team have an alternative society of supporting the relationships anywhere between you and your customers. I become section of it big people make it possible for smooth performance of one’s trustor’s vision. Together, we offer subscribers having an alternative approach and you may official solutions, providing them with satisfaction in any facet of its financial lifestyle. Within the 2007, we started a market-broad drive to have greater visibility to your financing results for personal subscribers and you can charities for the organization of your own Arc Personal Customer Indices. Arch try a honor-effective investment consulting habit informing household and you may charities across the 20 jurisdictions with assets lower than suggestions of GBP 18 billion.

Lucky 88 casino – The Very first-Hands Experience Opening a find High-Produce Savings account

All of us has shown an unparalleled hard work inside the approaching sustainability pressures. These prestigious honors are an excellent testament in our promise to drive important feeling and apply powerful durability procedures during the all of our financing tips and you can monetary guidance to the customers. We are really not no more than immediate fundraising; we’re seriously interested in cultivating a lot of time-label feeling. Because of the producing recite offering, donor purchase and sustained donor involvement, we let charities make, and you will develop a reliable monetary feet you to supports constant projects. Our very own objective is to do a ripple aftereffect of positive changes you to expands better beyond the initial donation. Inside 2023, Bailard turned a b Corp™, recognised to own meeting B Lab’s stringent criteria out of confirmed social and you may environment performance, corporate visibility, and you will liability.

Nonetheless they’ve advised him it’ll end up being paying their money to live really within the retirement as an alternative than just trying to retain it to exit a keen heredity. “The bank no longer should have POD from the membership term or perhaps in their information for as long as the fresh beneficiaries are noted someplace in the financial institution info,” Tumin told you. “If you are in this kind of shoes, you have got to focus on the lending company, as you may not be in a position to intimate the fresh membership or change the membership until they grows up,” Tumin said. Beneath the the newest laws and regulations, trust deposits are actually limited to $1.twenty-five million inside the FDIC publicity per trust owner for each insured depository establishment. For those who have $250,100 otherwise smaller deposited inside a lender, the brand new change does not connect with you. FDIC insurance essentially covers $250,000 for each and every depositor, for each and every bank, in the for each account ownership group.

Begin your wealth journey having a Citi account.

Plus it’ll get a bit to have millennials and you will Gen Zers to share regarding the largesse. The new benefactors are primarily baby boomers, moving a few of the nice wealth of numerous collected on the blog post-World war ii financial boom and from inventory and you will home enjoy within the lucky 88 casino current ages. However, because of the 2039, millennials are forecast to help you outpace him or her while the greatest inheritors of intergenerational riches, all the more joined by Gen Z. A version of this article basic starred in CNBC’s Inside Money newsletter having Robert Frank, a regular self-help guide to the brand new higher-net-value investor and user.

Large Give has been running match money campaigns for more than 15 many years, elevating £300m for British causes. This type of strategies is catalysed by ‘Champions’ – trusts and you may foundations, high-net-really worth someone, enterprises, and you will societal funders – which provide the brand new fits investment. Normally, these Winners contribute five, half dozen or seven-shape figures so you can Huge Give campaigns. By the combining a new suits funding model with strategic partnerships, electronic empowerment, and you can a focus on visibility and long-name impact, i’ve authored a system to own driving important public and you will environment alter.

- Mars is the Walmart out of chocolate—an excellent multigenerational family company that’s common and you can wildly popular.

- Because the a consumer, placing your money in the accounts you to definitely earn significantly more versus average mode your own balance is also build reduced.

- Unmarried filers which have revenues anywhere between $20,100 and you will $thirty five,100 be eligible for smaller benefits.

- You can expect imaginative alternative financing options round the all the resource classes thus that you might line up their wide range as to what matters to you.

Profile

This process lets us provide more eco-friendly and renewable methods to our very own customers while you are boosting our functional efficiency. Forbes Coach have recognized an educated brokerage account incentives considering the benefit’s dollars really worth, investment minimums or any other qualification criteria. I compared also offers of twenty-five leading brokerage membership to find specific of the greatest bonus now offers offered. Yes, interest attained from a high-give savings account is usually experienced taxable income and may getting said once you file the taxes. For many who earn no less than $10 inside demand for a calendar year, the financial will issue you Function 1099-INT, which facts the amount of focus you gotten. The quantity and you will volume away from changes varies with regards to the bank’s principles, battle and you may outside financial points like the Given’s changes in order to its standard rates.

- RBC’s vision would be to assist customers prosper and you can teams do just fine and so it beliefs is mirrored in all our very own strategies and products.

- The new revolves is actually intended for the newest Quirky Panda on line slot away from Games Global business.

- Evaluating the characteristics out of casinos on the internet needed with the set of requirements, we make sure by 2025, these sites are the most useful for Canadian professionals.

- As a result of courses, mentorship, and you will availability, the applying not merely contact the newest quick pressures as well as paves how to own a comprehensive and powerful world.

- You to definitely big difference ranging from securities vs. Cds is that Dvds is actually a banking equipment, if you are bonds is exchanged.

The fresh views expressed in this reviews are those of your own blogger and may also not at all times reflect those held by the Kestra Financing Features, LLC or Kestra Advisory Features, LLC. This really is for standard guidance just and that is perhaps not intended to give particular financing suggestions or ideas for anybody. It is strongly recommended which you speak to your economic top-notch, lawyer, or tax advisor regarding your own personal state. Playing with variation in your financing approach none assures nor guarantees finest overall performance and should not stop death of dominant due to modifying industry conditions.

Indeed, the newest Fed reduce interest rates in Sep, November, and you can December 2024 meetings. The fresh Fed’s monetary forecasts indicate that Computer game rates you’ll always slide since the much subsequently because the 2027. While you are trying to find an informed Cd prices for older people, for example, you might find Cds that provides greatest desire rates to have elderly people. And if you are looking for planning retirement, you might want to consider IRA Dvds more antique Cds. Some other disadvantage to financial with EagleBank would be the fact the cellular financial application provides lackluster ratings.

Its lack of a universal standard inside the durability complicates investigation precision, so we purchase heavily within the converting research to make certain comparability and quality, reflecting its significance within the funding procedures. Getting a tax refund annually away from many — if not thousands — from dollars may seem sweet, however you would be spending that cash and you will growing their wide range. For many who’re making a respectable amount of income but really haven’t become worried about making the most of your bank account, it’s time for you meet up a-game plan. The newest CDIC covers qualified places at the their member organizations to have upwards so you can $a hundred,100000 (as well as prominent and you can desire) for every covered put classification. From the integrating with multiple CDIC participants (as opposed to are you to definitely our selves) we’re also in a position to mix such pros and you may bring you greater comfort from notice.

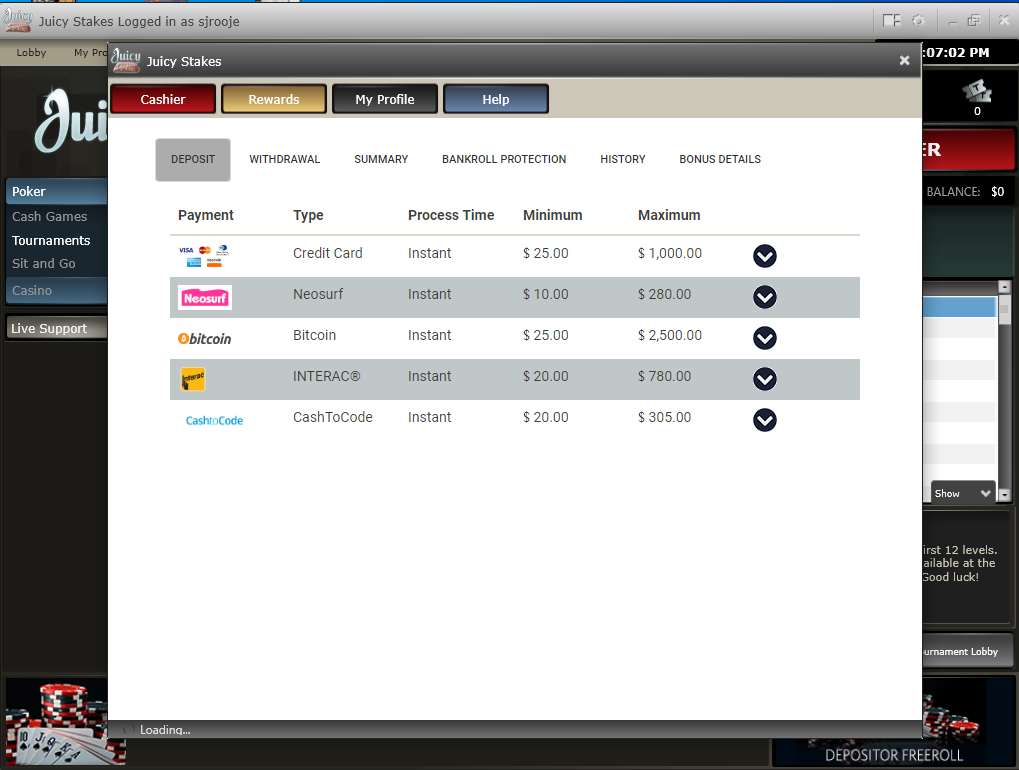

During the CasinosHunter, my personal people simply recommends $step 1 deposit casinos one to fulfill all our high quality criteria. Axos Private Buyer Financial’sinsured cash sweep system grows the Government Put Insurance policies Firm (FDIC) coverage as much as $240 million inside places. Members appreciate light-glove solution, no financial charge, highest purchase limits, totally free home-based and you will global cables, money benefits, and amenities such VIP access during the more step 1,2 hundred airport lounges around the world. You’ll need to manage the absolute minimum harmony out of $250,100 in order to qualify for Private Consumer Financial. Cd ladders will help mitigate the danger which you can need to withdraw their money before the CD’s term size is actually upwards. However, Cds wouldn’t get you normally cash on average since the opportunities perform.

FinServ provides impacted more than 500 students by integrating along with 40 Universites and colleges. Founded within the 2019, FinServ Basis is actually an excellent 501(c)(3) looking to solve the brand new ability and advancement drama within the finanical characteristics. This season, we’ve worried about structuring our knowledgeable and you may enchanting Individual Customer organizations to help you better suffice our step 3,000+ UHNW and you can HNW clients if you are enhancing the party’s every day operations and you can profession innovation. We will always power our very own worldwide system – a global cooperation out of independent, powerful enterprises which can be specialists in the part. The lovers provide regional education and you may think leadership to the giving so you can the regions and you will collaborate with us discover the brand new a way to improve mix-edging providing.

![]()

Recently, i rented a couple of the newest faithful SII team members to enhance all of us, as well as our very own first Climate Changes Investing Specialist, and install more than 50 “Green and you will Impact Using Pros” across the corporation. Together with her, it offers welcome us to ingrain and size operate on the our center company offering. So it identification is actually greatly motivating for people and you may affirms the significance of our tech in order to advisors and you can donors.

All of our customers make use of an integral and you will varied enterprize model around the the whole bank. Responsible using is at the center of our own design at one’s heart your subscribers’ concerns and performs a vital role from the change of our own economic climates to a far more alternative design. I continue to be invested in assistance and indicates all of our members, business owners, and you may multi-generational family inside techniques, consolidating our very own solutions with the subscribers’ influence in addition to their need to handle sustainable advancement pressures.